Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

Connor is a Scottish financial expert, specialising in wealth management and equity investing. Based in Glasgow, Connor writes full-time for a wide selection of financial websites, whilst also providing startup consulting to small businesses. Holding a Bachelor’s degree in Finance, and a Master’s degree in Investment Fund Management, Connor has extensive knowledge in the investing space, and has also written two theses on mutual funds and the UK market.

keine Depotgebühren

Savings plan eligible funds and ETFs: 4500

I’ll admit it – I hadn’t heard of flatex until recently. Back in August 2020, when Degiro partnered with them, I was curious who flatex were and what they offered. So, I decided to do a little research of my own.

Founded in Germany in 2006, flatex are one of the nation's leading online brokers – in 2020 alone, they processed approximately 70 million transactions from around 1.2 million customers. They have won multiple awards in Germany for securities trading, with accolades such as 'cheapest broker', 'best ETF and leverage broker', and 'best online broker' being bestowed upon them.

So, having scoured their website for information (thanks Google Translate), I was intrigued. Seeing all the awards they had won, along with their acquisition of Degiro, made me want to know more. In this article, I will take you through my thoughts and opinions on flatex, guiding new and experienced traders alike who are wondering whether to open an account with them. So sit back, get comfy, and read on!

As always in my reviews, I'll start with the account opening process. Firstly, as mentioned previously, flatex are based in Germany – therefore, their services mainly target people who reside in that country and the countries surrounding it. Their website and platform are all in German, so if you do not speak the language (like me), you will need to use Google Translate for a few things.

As always in my reviews, I'll start with the account opening process. Firstly, as mentioned previously, flatex are based in Germany – therefore, their services mainly target people who reside in that country and the countries surrounding it. Their website and platform are all in German, so if you do not speak the language (like me), you will need to use Google Translate for a few things.

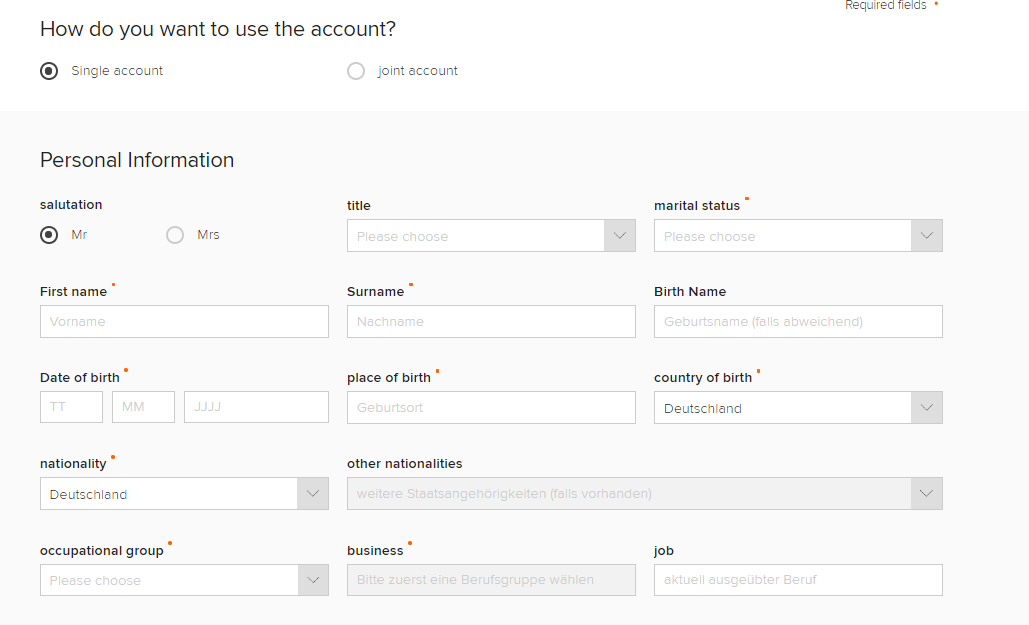

In terms of the account opening process at flatex, it is a little bit more complicated than other brokers. Users can start the process online, and again, this is entirely in German, which makes the process slightly longer to complete. You must choose the type of account you’d like – flatex will open new accounts as ‘cash and securities’ accounts as standard, but you can change this later to include FX if you wish.

Once you've chosen your account type, you need to verify yourself before you can open the account. This verification is where things got a little tricky. At flatex, their fully digital account opening services are only available to German or Austrian residents. So if you are from the UK, like me, you have to verify your identity by sending them physical documents that act as Proof of Identity and Proof of Address.

Once flatex have received your documents and processed them, they will send you your login details along with what they call an 'iTANCard'. This card is needed to login and also place trades. After these have been received, you are good to go as flatex do not require any minimum deposit to begin using your account – great news!

Now let’s look at the fees for flatex. Firstly some excellent news for you traders out there who are thinking about signing up – flatex do not charge any non-trading fees at all. What I mean by this is that they do not charge a monthly account fee, an inactivity fee, a deposit fee, or a withdrawal fee. This is a great advantage of using flatex, as it means you only need to worry about direct trading-related costs.

In terms of trading fees, flatex operate on a commission system. What this means is that you pay a flat fee for each trade you make with them. Their fees are pretty average – each trade you make will cost you €5.90, which is around £5. A pretty cool point to note is that this fee does not change depending on the trade volume; you will still pay a £5 commission whether you are opening a £10 position or a £1000 position.

This £5 commission is the case across the board, whether you are trading stocks, bonds, or even funds. One thing I did notice when I was doing my research was that flatex charge a higher amount of fees for FX trading, though. Placing an FX trade with flatex means you have to pay a commission, the spread, and financing costs, all of which can add up. So this is worth keeping an eye on if you intend to use them for trading forex.

Once I had signed up and had thoroughly researched their fees, I then decided to take my first foray onto their platform. As mentioned in some of my other reviews, I feel that a broker's platform is one of the most critical aspects of their services. They could have the cheapest fees in the world, but if their platform isn’t up to scratch, then it makes the process of trading a lot more burdensome than it has to be.

Once I had signed up and had thoroughly researched their fees, I then decided to take my first foray onto their platform. As mentioned in some of my other reviews, I feel that a broker's platform is one of the most critical aspects of their services. They could have the cheapest fees in the world, but if their platform isn’t up to scratch, then it makes the process of trading a lot more burdensome than it has to be.

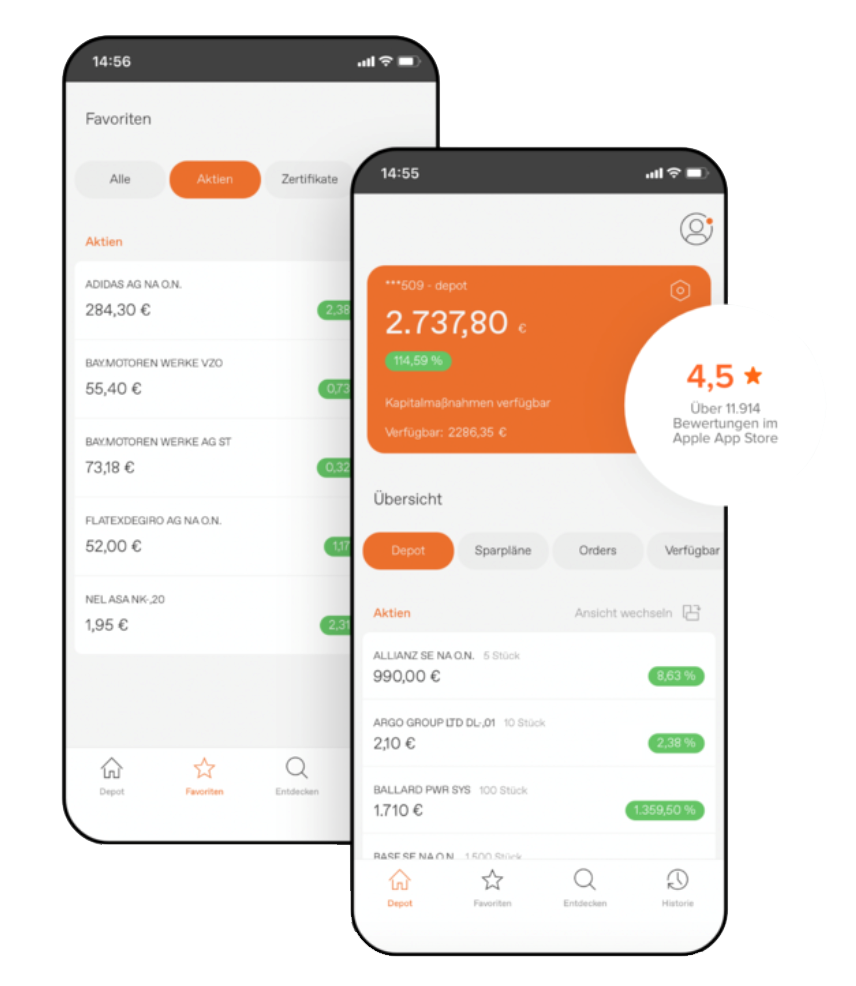

The first thing to note about the flatex platform – it is all in German. However, the good thing is that it’s all pretty self-explanatory, so in my opinion, it doesn’t matter too much if you don’t speak the language. The platform allows all the usual features you’d expect from an online broker – the ability to place trades, a search function to find new securities, a visual representation of your portfolio, amongst other things.

I really liked the 'feel' of the flatex platform. Even though it may appear daunting for English speakers, it's very straightforward to use, and once you know where everything is, the language barrier doesn't pose an issue. What's more, flatex also offer a mobile app that is available on both iOS and Android. This app has the same look and feel as the web app, which means that once you are comfortable with

the former, the latter should be a piece of cake.

The last thing I wanted to touch on in this review is the range of products that flatex offer through their brokerage. This is where they shine, as they offer a wide variety of asset classes to trade, meaning that most traders will be able to find what they are looking for.

The flatex platform allows you to trade stocks, ETFs, FX, funds, and bonds. What's more, they offer 22 stock markets for you to choose from, ranging from the US market right down to Swiss markets. However, one of the best features about flatex is that they allow you to trade US penny stocks. These stocks are popular with traders worldwide for their potential to skyrocket and make investors a great return. Currently, not many brokers offer penny stocks as tradeable securities – yet flatex do. I think this is fantastic news for traders who have a larger tolerance for risk and are looking for potential returns that exceed what they could get in traditional equity markets.

| Flatex | |

|---|---|

| Stocks | Yes |

| ETFs | Yes |

| FX |

Yes |

| Funds |

Yes |

| Bonds |

Yes |

| Options | No |

| Futures | No |

| CFDs | No |

| Cryptocurrencies |

No |

| Interactive Investor | |

|---|---|

| Account Fee | No |

| Inactivity Fee | No |

| Deposit Fee | No |

| Withdrawal Fee | No |

| Interactive Investors | |

|---|---|

| Bank Transfer | Yes |

| Credit/Debit Card | No |

| Electronic Wallets |

No |

So, let me summarise my thoughts on flatex overall. As mentioned, I hadn't heard of them until recently, and I am thrilled that I did. Although they are based in Germany and not directly targeted at the UK market, I feel that their services will be an attractive prospect for many non-German traders. Yes, their platform and website are entirely in German. However, as someone who does not speak the language, I would honestly say that it isn't a huge issue as most of the features are relatively self-explanatory once you get onto the platform.

In finishing, I would say that flatex is a broker that both new and experienced traders should consider if they are looking to open a new account. Their flat-fee pricing means you always know how much you're going to have to pay, and their provision of penny-trading services is a great perk that sets them apart from many other brokers. So if you are on the fence about flatex – take the plunge, open an account, and see if you like what they have to offer.

★★★★★

Sign

up your email to receive updates on when we review new stockbrokers,

banks, and other finance platforms.

We will not spam and we will not share your email address with any

third parties or other websites. You will only be notified of

potential introductory offers from our existing financial institutions

list or new vetted institutions of interest on the online market.

We are not a financial advisory service. No investment advice

shall be given through this contact form.

* indicates a required field

We carefully assess each online finance website to strict standards and compare them across a wide range of criteria. Although each company will always have a slightly different set of advantages and disadvantages to their platform, the assessments are based on general performance, reliability, bonuses given, and other factors which are usually found or sought after in all financial institutions.

Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

An excellent service and it came just at the right time. After several unsuccessful attempts at a previous unknown banks, this was what I needed. Thank you Online Finance World!

Choosing the right platform that I will stay with for a long time made me nervous. And with so few good comparison sites for German banks, I thought I'd never decide... until I stumbled upon Online Finance World.