Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

Connor is a Scottish financial expert, specialising in wealth management and equity investing. Based in Glasgow, Connor writes full-time for a wide selection of financial websites, whilst also providing startup consulting to small businesses. Holding a Bachelor’s degree in Finance, and a Master’s degree in Investment Fund Management, Connor has extensive knowledge in the investing space, and has also written two theses on mutual funds and the UK market.

I had known about Interactive Investor for quite some time but had never taken the plunge and opened an account with them. It was just one of those things that I kept meaning to do and just never got round to it. But then, as I was scrolling YouTube one evening, I noticed a video from Interactive Investor's channel in my suggestions.

The video's production quality was incredible, and it sparked the idea that perhaps I should check them out. In this article, I will give my thoughts and feelings on Interactive Investor – where they do well and where they could improve. As always, grab a beverage of choice, sit back, and read on!

Firstly, let’s take a quick look at Interactive Investor’s background. Founded back in 1995 in the UK, they are an online investment service designed for both retail and professional traders. As noted by the Financial Times in 2020, they are currently the UK’s largest flat-fee (more on this later) investment platform. This has been achieved through the relentless acquisition of smaller firms over the previous 16 years – Integrative Investor has absorbed companies such as Moneywise, Alliance Trust Savings, and The Share Centre to strengthen its market position.

It's always wise to quickly touch on regulation too. As traders, we realise how important this facet of choosing a broker is, and luckily, there's nothing to worry about with Interactive Investor. They are regulated by the Financial Conduct Authority (FCA) and have a long track record in the sector – so good news all round!

Interactive Investment's account opening process was incredibly straightforward. It can all be done online, which is always a plus in my book; furthermore, they do not ask for crazy amounts of documents to verify you. All I had to provide was the standard two requests when starting with a broker – proof of ID and proof of address. Again, these could just be uploaded using Interactive Investor’s digital platform.

Another nice thing about Interactive Investor is that they don't require a minimum deposit when opening. This is one of the key things I look for when opening an account, as it lets you experience the platform and features without roping you into depositing a chunk of cash. Interactive Investor also offers a demo account – great news for new traders who want to test the waters before diving in!

For me, a broker's platform is one of the most critical elements of the trading experience. As traders, we spend inordinate amounts of time staring at charts and placing trades, so a clean platform is a must-have. In terms of Interactive Investor, they excel in some areas, but they could improve a couple of things.

For me, a broker's platform is one of the most critical elements of the trading experience. As traders, we spend inordinate amounts of time staring at charts and placing trades, so a clean platform is a must-have. In terms of Interactive Investor, they excel in some areas, but they could improve a couple of things.

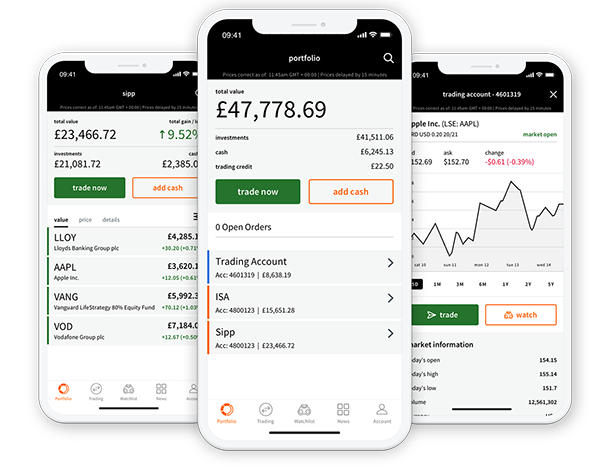

The first thing I noticed was how clean the layout was – minimalist and easy to navigate. It clearly shows your portfolio composition in a handy pie chart, and you can see your cash on hand and the value of your investments. Their platform has all the important stuff you’d expect – you can place orders, check trades, and deposit/withdraw money.

The mobile platform has a similar layout. It is clean and easy to use and provides pretty much the same functionality as the web app. However, one minor drawback for traders is the inability to set price alerts. Most people (myself included) would prefer to set alerts directly on the broker's app; if this isn't an option, it is then the case that traders must use another app. It's not a huge deal, just a minor annoyance more than anything.

Something I found pretty cool about Interactive Investor is they operate through a 'flat-fee' system. The best way to think about this is like a subscription – you pay a monthly fee (depending on which plan you choose), and in turn, you get access to their platform and the various features. Currently, there are three plans for people to choose from – Investor, Funds Fan, and Super Investor.

When I signed up, I opted for the Investor plan as I was trying things out; this one is the cheapest of the three and costs £9.99 per month. This plan allows you to have one free trade per month, whilst the other plans will enable you to have two free trades. This is excellent news as Interactive Investor's fees for a single trade are slightly above average – it costs £7.99 to trade a UK stock.

A big plus for many traders is that Interactive Investor doesn't charge any inactivity fees, deposit fees, or withdrawal fees. What's more, their commissions on assets such as funds and ETFs are pretty decent. Overall though, what I would say is that due to their subscription-based service, Interactive Investor probably would be better suited to traders who trade more frequently; if you're paying a monthly fee, then it would make sense to get your money's worth.

| Investor | Funds Fan | Super Investor | |

|---|---|---|---|

| Monthly subscription fee | £9.99 |

£13.99 |

£19.99 |

| Fee per trade (UK stocks) | £7.99 |

£7.99 |

£3.99 |

| Fee per trade (US stocks) |

£7.99 |

£7.99 |

£4.99 |

| Fee per trade (other stocks) |

£19.99 |

£19.99 |

£9.99 |

| Fee per trade (UK funds) |

£7.99 |

£3.99 |

£3.99 |

| Interactive Investor | |

|---|---|

| Account Fee | Yes |

| Inactivity Fee | No |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Interactive Investors | |

|---|---|

| Bank Transfer | Yes |

| Credit/Debit Card | Yes |

| Electronic Wallets |

No |

I think the range of investments that Interactive Investor offers is pretty decent, but there are some areas they could improve slightly. They offer an extensive selection of stocks, allowing users to trade in 16 different markets. They also provide 1500 ETFs to invest in, which is great for people like me who are interested in passive investing.

In my opinion, one potential drawback for users might be that Interactive Investor doesn't offer FX or cryptocurrency trading. Now, I get that a lot of people won't be interested in these two trading sections. However, having them as an option would be nice, which may be an area that Interactive Investor looks at in the future.

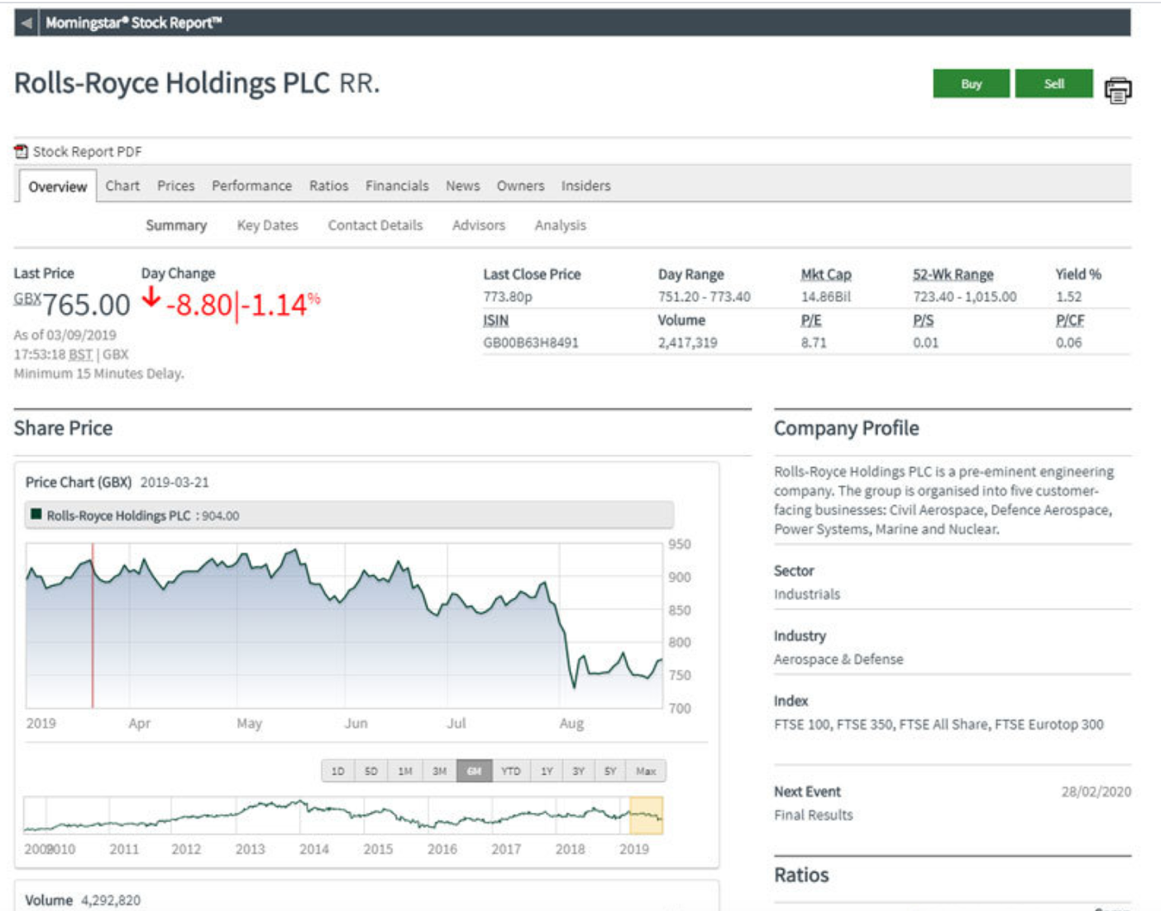

The final point I wanted to touch on is the research options that Interactive Investor has to offer. Now, this is an area I feel they excel in. Interactive Investor has extensive information on most of their assets – they draw their data from Morningstar, the industry standard for financial information. What's more, they offer quite a few types of trading ideas picked by experts within the company – these include their 'ii Super 60 investments' and their 'Quick Start Funds'.

They also offer charting on their web and smartphone platforms – however, in my opinion, it could be doing with a little work. The charts are pretty basic, and Interactive Investor does not offer a large selection of tools or indicators. So, for those of you who love doing technical analysis, it might be wise to use another app for your charting needs.

So, let's wrap things up here. I really enjoyed my experience using the Interactive Investor service. Their platform is very straightforward to use and allows for all the essential functionality you'd expect. Also, they possess a good range of investments and offer large amounts of research too. Their fee structure might not be to everyone's liking, and their charting could do with a little work; however, on the whole, I believe Interactive Investor is a dependable broker with an excellent track record and will definitely appeal to a wide range of potential investors.

★★★★★

Sign

up your email to receive updates on when we review new stockbrokers,

banks, and other finance platforms.

We will not spam and we will not share your email address with any

third parties or other websites. You will only be notified of

potential introductory offers from our existing financial institutions

list or new vetted institutions of interest on the online market.

We are not a financial advisory service. No investment advice

shall be given through this contact form.

* indicates a required field

We carefully assess each online finance website to strict standards and compare them across a wide range of criteria. Although each company will always have a slightly different set of advantages and disadvantages to their platform, the assessments are based on general performance, reliability, bonuses given, and other factors which are usually found or sought after in all financial institutions.

Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

An excellent service and it came just at the right time. After several unsuccessful attempts at a previous unknown banks, this was what I needed. Thank you Online Finance World!

Choosing the right platform that I will stay with for a long time made me nervous. And with so few good comparison sites for German banks, I thought I'd never decide... until I stumbled upon Online Finance World.