Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

Connor is a Scottish financial expert, specialising in wealth management and equity investing. Based in Glasgow, Connor writes full-time for a wide selection of financial websites, whilst also providing startup consulting to small businesses. Holding a Bachelor’s degree in Finance, and a Master’s degree in Investment Fund Management, Connor has extensive knowledge in the investing space, and has also written two theses on mutual funds and the UK market.

Plus500 is a broker that most people will have heard of – their adverts are plastered all over TV, Instagram, and YouTube. Thought of as one of the most recognisable brokers in the UK, Plus500 has been in operation since 2010 offering online trading services. User growth accelerated throughout 2020, providing Plus500 a stable platform to solidify its market position in the UK.

A few of my friends have been raving about Plus500 for a while now, urging me to take the plunge and open an account. So I thought, why not? This article will provide my thoughts on Plus500 as a broker, touching on all the essential points you need to know. Let's go!

As always, the first thing that I like to discuss in these reviews is the account opening process. If this process is slow and clunky, it can often leave a bad taste in the mouth before the broker's services have even been used. Luckily, this isn't the case for Plus500.

The first thing to note – they have a trustworthy reputation throughout the trading community, mainly due to them being listed on the UK's stock exchange. Furthermore, Plus500 is regulated by several top-end authorities, such as the Financial Conduct Authority (FCA). For myself and many traders, this is one of the first things we look for when opening an account.

In terms of the actual account opening process, Plus500 has made this so straightforward. One thing that really bugs me when opening a new account with a broker is when they require physical paper documents to be mailed to them in order to verify you – this isn't the case with Plus500. Everything can be completed through their website, including the upload of Proof of Identity and Proof of Address documents.

The last point to note on this process is that Plus500 does require a minimum deposit before you can open your account. The good news is that it's only $100, which I think is a fair amount compared to other brokers. Deposits are free to make, and can be done via bank transfer, credit/debit card, or electronic wallets. Once the money hits your account, you're good to go!

So, how do Plus500's fees stack up against their peers? Well, it's important to note a key detail about Plus500's services – they are exclusively a CFD broker. Now, you're probably thinking, "What does this mean?". Let me break it down for you.

So, how do Plus500's fees stack up against their peers? Well, it's important to note a key detail about Plus500's services – they are exclusively a CFD broker. Now, you're probably thinking, "What does this mean?". Let me break it down for you.

CFD stands for Contract For Difference. In simple terms, when you trade CFDs, you do not own the underlying asset. Instead, you trade a 'contract' based on the price of that asset. This contract pays out the difference between the price you buy or sell at, and the price you settle at. CFDs are a great way to speculate on a security’s price without actually owning the underlying asset.

Circling back round to Plus500, the fact they are a CFD broker changes their fee structure slightly. Firstly, Plus500 does not charge any commission on CFD trading using their services – great! Instead, they make their money through the 'spread', which is the small difference between the bid and ask prices quoted by the broker. Ask prices are the price that brokers sell at, and bid prices are the price that brokers buy at – ask prices are usually higher than bid, meaning the broker gets to keep the difference as profit on each trade.

But what does this mean for traders like you and me? Well, in terms of Plus500, their fees for trading stock CFDs and Forex are pretty average. It's hard to provide precise amounts as they are incorporated into the spread, but typically this spread isn't anything crazy. So, overall, it can work out cheaper than other brokers a lot of the time!

Finally, there are no withdrawal or deposit fees, which is always great news for traders. However, Plus500 does charge an inactivity fee of $10 for every three months of inactivity. It's not all bad thought – you simply have to log in to your account, and that'll be classed as an activity, saving you this fee. I think this is a great feature, as most other brokers make you place a trade to save on inactivity fees.

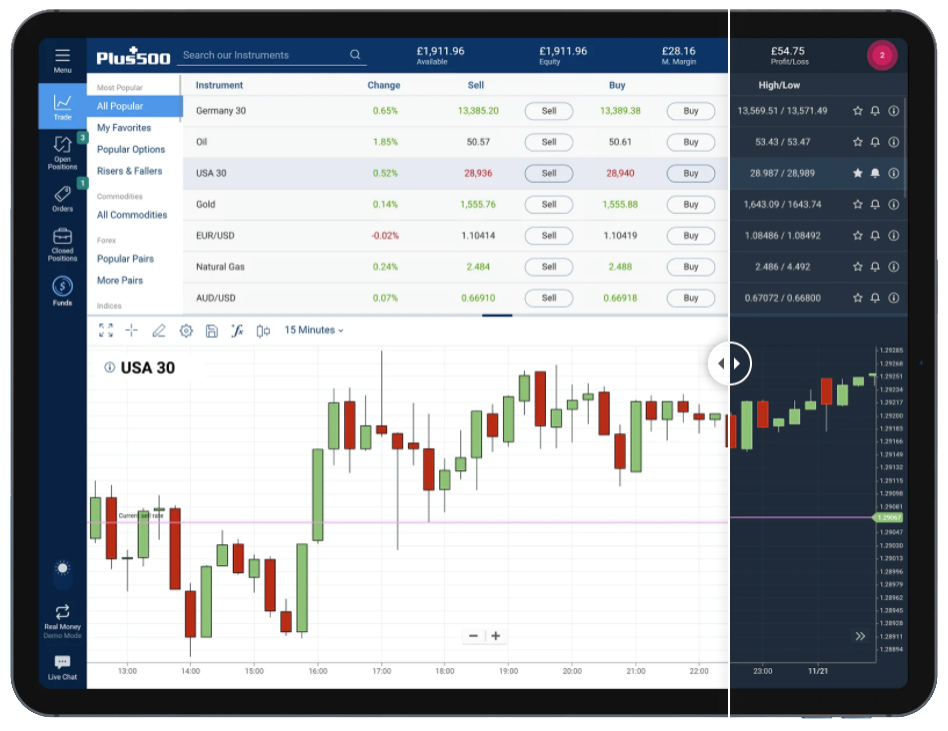

Those of you who read my reviews will know that I’m a sucker for a good trading platform. I believe that it is one of the most fundamental components of a good broker, as it makes life so much easier. Fortunately, Plus500’s platform ticks all the boxes!

Those of you who read my reviews will know that I’m a sucker for a good trading platform. I believe that it is one of the most fundamental components of a good broker, as it makes life so much easier. Fortunately, Plus500’s platform ticks all the boxes!

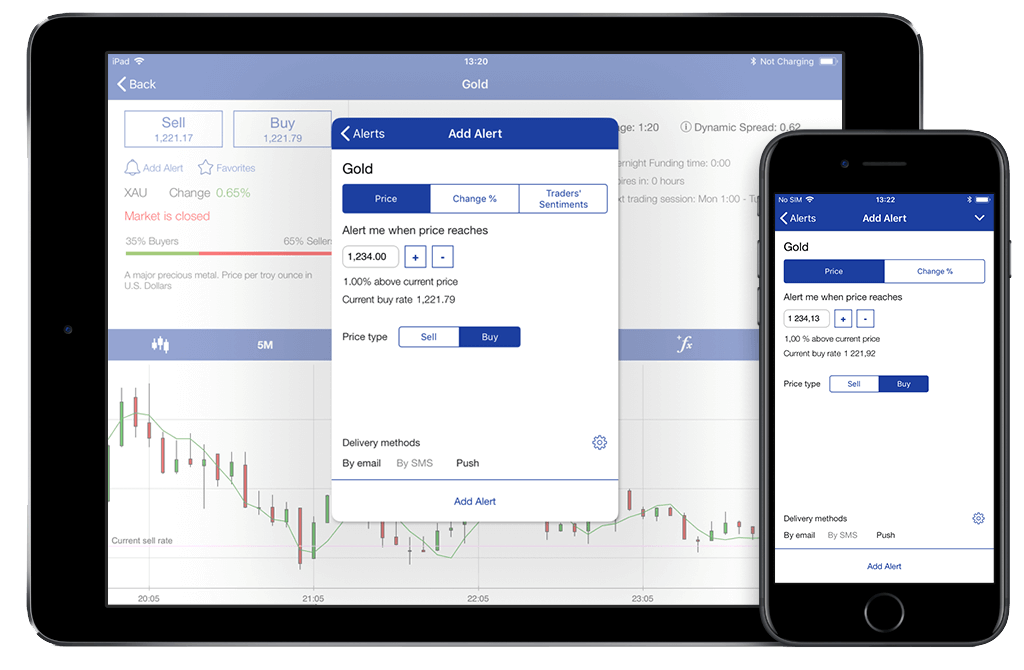

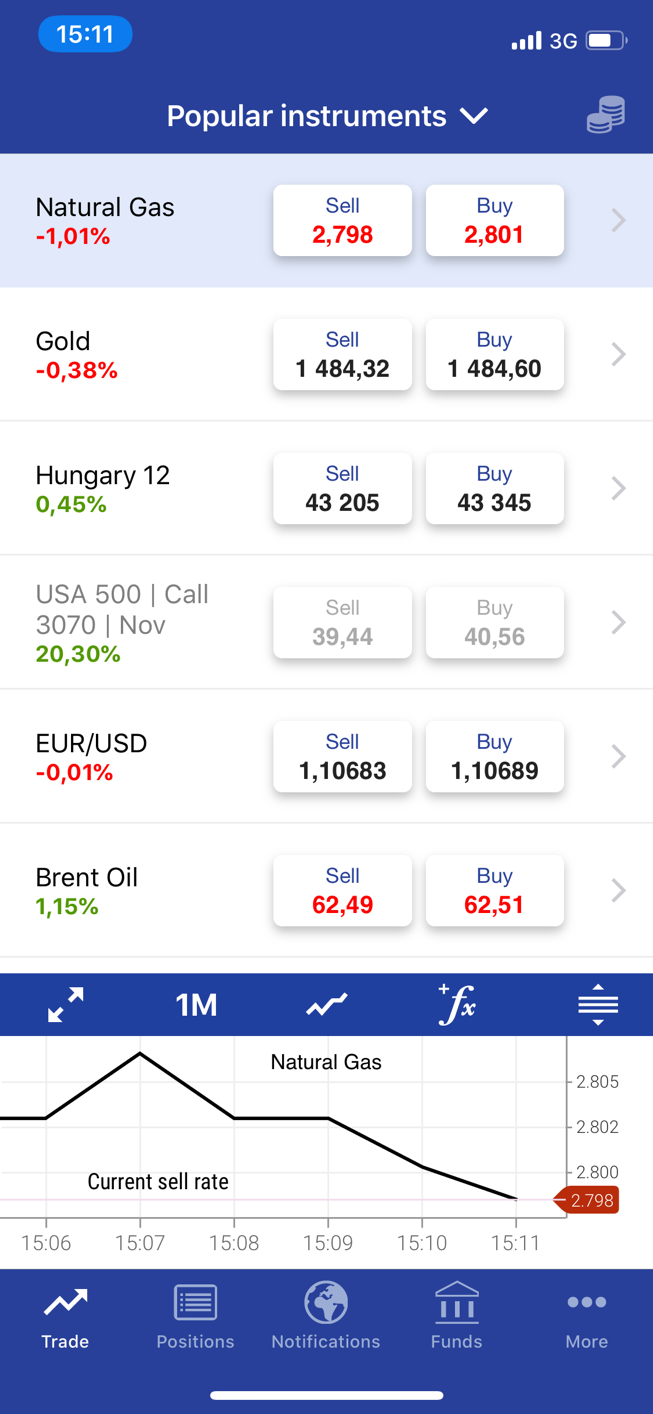

Plus500 offer both a web-based platform (Webtrader) and a mobile platform. The great news is that these platforms work seamlessly together – you can begin trading on your computer, and then if you want to check things on your phone, everything will be consistent across the board. Layouts are clean and straightforward, with buttons highlighting how you buy and sell and a search function that makes it easy to find the securities you're looking for.

One of my favourite things about the Plus500 platform is its 'Dark Mode' feature – great for protecting your eyes during those late-night trading sessions! Also, alerts can be set that immediately notify you when your chosen security hits a specific price. Finally, Plus500 offer charting too, allowing you to conduct your technical analysis directly on the platform. Overall – I can't fault anything!

The final point I want to touch on in this article is the range of products that Plus500 offer. As mentioned, they are a CFD broker, so their range of products is comprised of CFDs based on a variety of underlying assets. The good news is – there are lots to choose from.

The range of CFDs that Plus500 offer is extensive, covering stocks, stock indices, and Forex. The broker used to offer Cryptocurrency CFDs too, but the FCA recently banned these for retail clients due to their volatile nature, so unfortunately this is no longer an option. However, with nearly 2000 stock CFDs to choose from, most traders will be pleased with the trading options available to them.

| Amount of Products | |

|---|---|

| Stock CFDs | 1900 |

| Stock index CFDs | 26 |

| Currency Pairs |

70 |

| ETF CFDs |

95 |

| Commodity CFDs |

25 |

| Plus500 | |

|---|---|

| Deposit Fee | No |

| Withdrawal Fee | No |

| Account Fee | No |

| Inactivity Fee | Yes |

| Plus500 | |

|---|---|

| Credit/Debit Card | Yes |

| Bank Transfer | Yes |

| Electronic Wallets |

No |

So, I'll wrap this up here and give you my overall thoughts. Personally, I really like Plus500 – they offer a cost-effective and reliable way to speculate on your desired securities. Their platform is fantastic and makes the process of placing a trade very easy. Some people may not like the fact they only offer CFDs, and that's fine. However, on the whole, I believe Plus500 provide everything you could want from a broker.

★★★★★

Sign

up your email to receive updates on when we review new stockbrokers,

banks, and other finance platforms.

We will not spam and we will not share your email address with any

third parties or other websites. You will only be notified of

potential introductory offers from our existing financial institutions

list or new vetted institutions of interest on the online market.

We are not a financial advisory service. No investment advice

shall be given through this contact form.

* indicates a required field

We carefully assess each online finance website to strict standards and compare them across a wide range of criteria. Although each company will always have a slightly different set of advantages and disadvantages to their platform, the assessments are based on general performance, reliability, bonuses given, and other factors which are usually found or sought after in all financial institutions.

Online Finance World helped me choose exactly the right platform that suited me best. As a beginner, that little extra help and information to get started was closer than I thought.

An excellent service and it came just at the right time. After several unsuccessful attempts at a previous unknown banks, this was what I needed. Thank you Online Finance World!

Choosing the right platform that I will stay with for a long time made me nervous. And with so few good comparison sites for German banks, I thought I'd never decide... until I stumbled upon Online Finance World.